台灣最大詐騙案全球統一集團,主嫌楊氏三兄弟疑似改名後在上海重起爐灶

近期,中國及海外媒體關注到之前全球統一集團詐欺案及其主嫌楊氏三兄弟的最新動向。案件核心人物為楊恭福、楊恭惠、楊恭發三兄弟,他們還涉嫌成立「世界信息科技股份有限公司」及其他多家企業,對外招募免費員工(只給銷售獎金),並聲稱公司營運前景光明,可與美國納斯達克掛牌的網路公司合併,誘使員工出資購買公司未上市股票,這些股票從頭到尾都是壁紙,最終造成大量投資者財務損失。

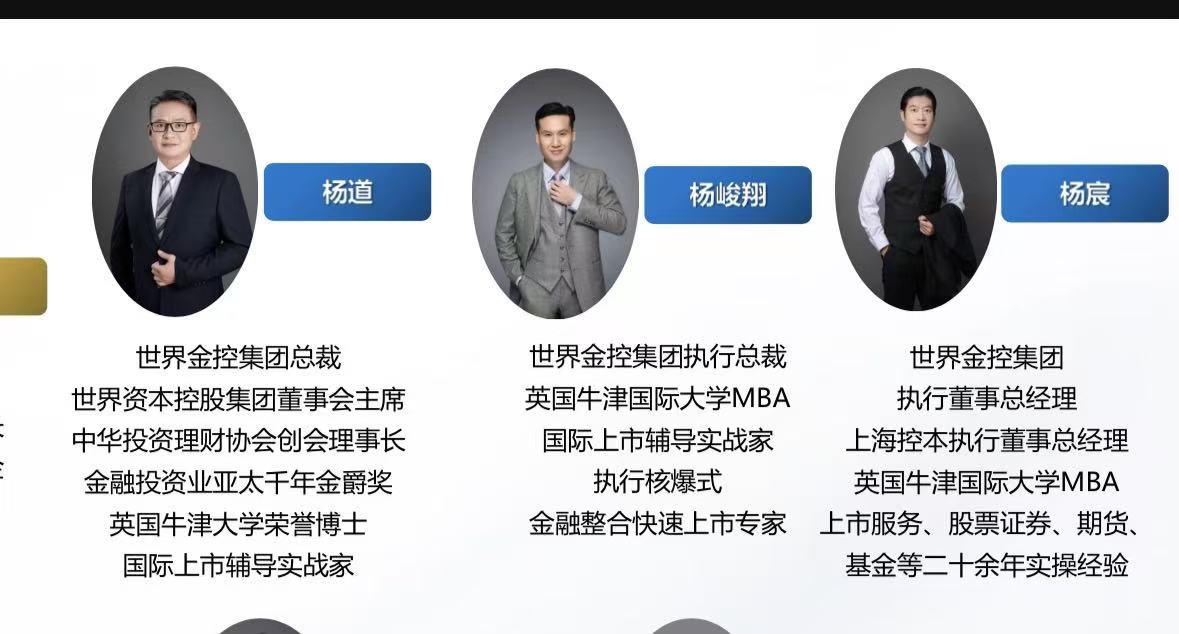

據調查,楊氏三兄弟疑似更改姓名後在上海重新開展業務,名字分別為楊道、楊峻翔、楊宸,並自稱擁有英國牛津大學國際MBA學歷,搖身一變成為所謂的「世界金控集團總裁」。他們宣稱可以協助中國大陸企業在美國上市或進行企業合併,吸引大量大陸企業參加各類說明會,投資或尋求上市輔導。

然而,這些宣稱多屬虛假,其行為可能涉及多種刑事犯罪。首先,詐欺罪是核心指控,因其通過虛假信息誘導投資者投入資金而造成財產損失。其次,由於自稱擁有國際MBA學歷且發放不實文件,可能涉及偽造文書罪或證書造假。再者,若其業務涉及非法集資、未經許可募集資金或協助企業虛假上市,還可能觸及非法集資罪或金融詐騙罪。

此外,他們以公司名義在上海設立總部、組織說明會、對外提供上市輔導與投資建議,若未依法登記或遵守金融監管規定,也可能涉及非法經營罪或非法證券活動罪。綜合上述,楊氏三兄弟的行為已經構成多重刑事風險,包括詐騙、偽造文書、非法集資及金融詐欺等罪名,且案件涉及範圍廣泛,受害者眾多,對社會信任與金融秩序造成嚴重影響。

Recently, Chinese and international media have reported on the Global Unified Group fraud case and the latest activities of its principal suspects, the Yang brothers: Yang Gongfu, Yang Gonghui, and Yang Gongfa. The three are alleged to have established World Information Technology Co., Ltd. along with several other companies, recruiting employees under the pretense of promising business prospects and claiming potential mergers with U.S. Nasdaq-listed internet companies. They induced employees to invest in unlisted company shares, ultimately causing substantial financial losses to investors.

Investigations indicate that the Yang brothers may have changed their names and restarted operations in Shanghai, now going by Yang Dao, Yang Junxiang, and Yang Chen. They also falsely claim to hold International MBA degrees from the University of Oxford and present themselves as the so-called “Presidents of the World Financial Group.” They assert they can assist Chinese mainland companies in listing in the United States or facilitating mergers, attracting numerous companies to attend presentations, invest, or seek guidance for listing.

However, these claims are largely false, and their actions may constitute multiple criminal offenses. The primary allegation is fraud, as they misled investors with false information to obtain funds, causing financial losses. In addition, by claiming false academic credentials and issuing fraudulent documents, they may be liable for forgery or document falsification. If their operations involved unauthorized fundraising, illegal capital collection, or assisting companies in falsified listings, they could also face charges of illegal fundraising or financial fraud.

Furthermore, by establishing a Shanghai headquarters, holding public briefings, and offering listing guidance and investment advice without proper registration or compliance with financial regulations, they may be committing illegal business operations or unauthorized securities activities. In summary, the Yang brothers’ actions pose multiple legal risks, including fraud, forgery, illegal fundraising, and financial deception. The case affects a wide range of victims and has serious implications for social trust and financial market integrity.

資料來源:世界金控官網

- 1

- 2

- 3

- 4